Who in the world would buy alternative protein food made from insects? European analysis has answers

Alternative protein foods have been hitting the supermarket shelves, but with options from insects to seaweed, who is buying what and where?

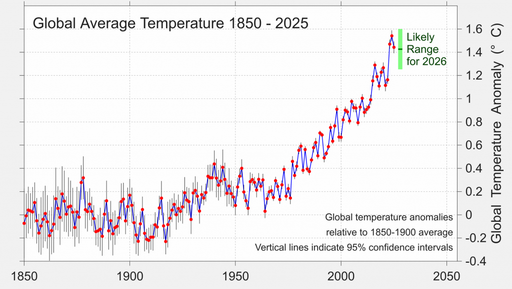

There are many reasons consumers appear to be favouring alternative meat products, not only around concerns about ethics of animal treatment but environmental concerns around climate change.

Conventional sources of protein are usually from meats such as beef and pork, but new alternative protein products have been introduced to the supermarket shelves, whether based on mushroom, algae, soya or even insects.

The insect option might sound surprising, but insect-based protein products keep being released, even "bug milk". The BBC has even advocated for the nutritional benefits of these invertebrates: "Insects are filled with lots of good nutrients, including amino acids and protein. These creepy crawlies may look small, but they can provide as much - if not more - protein than beef!"

You will eat ze bugs... - Bug Milk

— Camus (@newstart_2024) May 4, 2024

Entomilk, a dairy alternative bug milk made from black soldier fly larvae and rich in protein, fat, calcium, iron and zinc, is being produced in Cape Town by Leah Bessa -- who also experiments with the substance, turning it into insect ice pic.twitter.com/aHYAyYdjsl

Many meat eaters even opt for plant-based foods or burgers sometimes only because of feeling tastier or healthier. Europe is the leading market in producing and selling alternative protein foods but there has been a lack of research into how countries are differing in their preferences for these food choices.

Analysis across the European continent

Researchers from SWPS University with a team in Germany, Denmark, Greece, Norway and Italy, analysed consumer demands in Europe around alternative protein food products. They reviewed research across 11 databases belonging to peer-reviewed journals, including 25 studies taken in 18 countries of Europe.

Results published in showed that many consumers often rate hybrid products high (as combinations of conventional and alternative meat products) in being more healthy, ethical, nutritious and environmental friendly. This is particularly the observation in the UK, Germany, Spain and Denmark.

Cities like Helsinki and Paris also appeared to be quite open to alternative proteins, being more ethnically diverse where there are also more likely to be novel food outlets. For instance, Paris has the highest consumption of seaweed based alternative protein compared to another five major cities in France. This may or may not relate to a larger Asian population in Paris who already have an awareness of seaweed-based food.

Comparisons further east in Europe

Studies looking at consumers in Czech Republic and Poland appear to have less awareness of innovative food products and appear to be more reluctant to buy them in comparison. Coincidentally, these countries also are known to have high intakes of meats (such as compared to pulses) per capita between 2018-2020.

Perhaps perceptions in Poland will change as it was announced in recent years that a new $57.4m insect factory has been brought to the Polish town of Karkoszow, located not far from Berlin.

This hesitation to buy and consume alternative meat products could make sense if there is less awareness of them, what their ingredients and perceived benefits could be. Promotional campaigns can only build awareness around potential health and environmental benefits in addition to motivates around improved animal welfare.

Insect based food perceptions: who would buy?

Generally speaking, most consumers are reluctant to buy insect-based protein. This is even in countries where alternative protein products are more widely accepted, like in the UK and Spain, where 18-22% showed a willingness to try it.

“Food culture and eating patterns in Northern Europe might have changed in recent decades, whereas Italian food culture is considered one of the strongest in Europe, with over 200 food products, where meat plays an important role”, the team’s researcher from SWPS University mentioned.

In Scandinavia, consumers in Sweden and Finland show more positive perceptions about insect-based food. Those in Italy are even less likely to choose these foods, compared to those in northern and western Europe, the authors have said.

Source of the news:

Geographical context of European consumers’ choices of alternative protein food: A systematic review. Food Quality and Preference. DOI:10.1016/j.foodqual.2024.105174